In the fast-paced world of debt recovery, call centers play a pivotal role. These centers rely on the expertise of Debt Collection Managers for Call Center operations, who implement strategies and utilize technology to optimize the collection process. In the following article, we will explore various aspects of debt collection for call centers.

What Are Debt Collection Strategies for Call Centers?

Effective debt collection strategies are crucial to the success of call centers. By employing a combination of communication tactics and psychological understanding, agents can effectively negotiate with debtors.

One key strategy is the tiered approach, where different tactics are applied based on the age of the debt and the debtor’s history. Another strategy involves personalizing communication, which may include using the debtor’s preferred channels and tailoring messages to their situation.

The use of incentives for early payment or negotiation of payment plans can also be helpful. Agents trained in empathy and negotiation are more likely to secure payments while maintaining a positive relationship with the debtor.

How Do Automated Dialers Enhance Debt Collection?

Automated dialers have revolutionized the way call centers operate, particularly in debt collection. These systems, including predictive and progressive auto-dialers, significantly increase efficiency by eliminating manual dialing.

These technologies also ensure that agents spend more time talking to potential debtors rather than waiting for calls to connect. Predictive dialers are intelligent enough to dial multiple numbers simultaneously, connecting agents to the next available call without pause.

Furthermore, automated dialers help in maintaining compliance with regulations by adhering to call timing restrictions and do-not-call lists, reducing the risk of legal issues.

What Are the Benefits of Using an Omnichannel Approach in Debt Collection?

An omnichannel approach in debt collection ensures that multiple communication channels are integrated into a seamless user experience. This approach allows debtors to choose their preferred method of communication, be it through voice calls, emails, text messages, or even social media platforms.

It also provides a unified view of the debtor’s journey, enabling agents to tailor their strategies effectively. An omnichannel strategy helps in building trust with debtors, as they feel heard and understood across all touchpoints.

The consistency across channels ensures that the debtor receives a coherent message, which is crucial for maintaining clarity in communication.

Collection Call Center Manager: Essential Functions and Strategies

Collection Call Center Manager: Essential Functions and StrategiesHow Can You Improve Agent Productivity in a Call Center for Debt Collection?

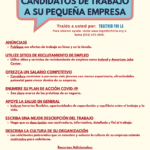

Improving agent productivity is essential for the effectiveness of a call center. Training and development programs can equip agents with the necessary skills to handle calls efficiently and effectively.

Additionally, the adoption of automation tools can free up agents from routine tasks, allowing them to focus on more complex interactions. Real-time analytics and performance dashboards can provide agents with insights into their performance, helping them fine-tune their approach.

Creating a supportive work environment, including incentive programs, can also motivate agents to reach their targets without compromising the quality of their interactions.

What Is the Role of CRM in Debt Collection Call Centers?

Customer Relationship Management (CRM) systems play a crucial role in managing interactions with debtors. They provide a centralized database that stores all debtor information, including contact details, communication history, and payment records.

A CRM system can automate workflows, ensuring that all debtors are contacted at the optimal times and with the right frequency. It can also assist in segmenting debtors based on their payment behavior, allowing for targeted communication strategies.

The integration of CRM with other tools, such as automated dialers or omnichannel platforms, can create a cohesive ecosystem that enhances the productivity and effectiveness of debt collection efforts.

How to Choose the Right Debt Collection Software for Your Call Center?

Choosing the right debt collection software for your call center involves considering several factors. The software should be user-friendly, offering an intuitive interface that allows agents to navigate easily.

It must also be scalable to adapt to the changing size and needs of the business. The software should provide detailed analytics and reporting features to track the progress of debt collection efforts.

Integration capabilities are essential, ensuring that the software can work seamlessly with existing CRM systems and other tools. Lastly, compliance features are crucial, as the software must adhere to industry standards and regulations.

Questions Related to Debt Collection for Call Centers

What Does a Collections Manager Do in a Call Center?

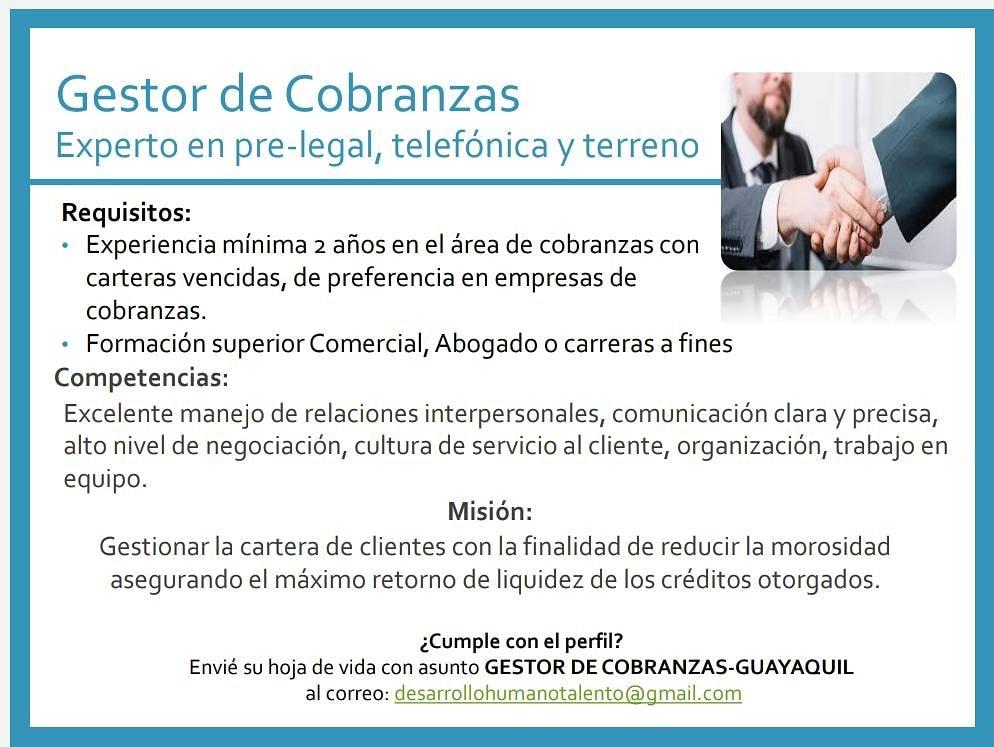

A collections manager in a call center is responsible for overseeing the debt recovery process. They develop and implement collection strategies, manage staff performance, and ensure that operations are efficient and compliant with regulations.

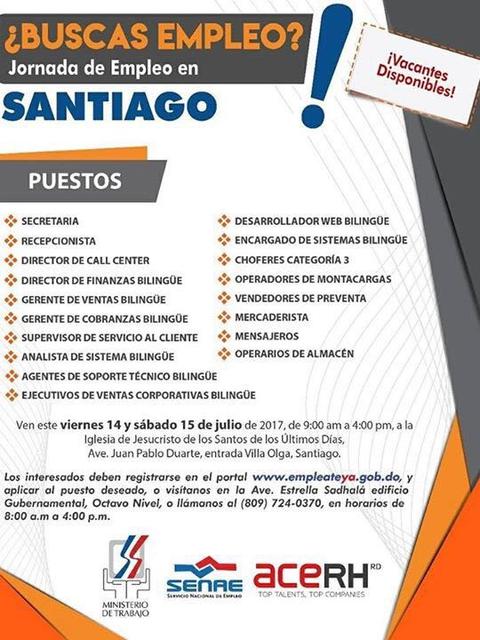

473 job offers in El Salvador

473 job offers in El SalvadorMoreover, these managers analyze data to identify trends and areas for improvement, collaborating with other departments to optimize the overall collections process.

What Does a Collections Supervisor Do in a Call Center?

A collections supervisor in a call center supports the collections manager by directly overseeing the team of collection agents. They provide training, monitor calls for quality assurance, and offer guidance and motivation to the team.

They also handle escalated calls, helping to resolve complex issues with debtors and ensuring a high level of customer service is maintained.

What Are the 3 Types of Collections?

There are generally three types of collections: consumer, commercial, and specialized. Consumer collections involve debts owed by individuals, while commercial collections focus on debts owed by businesses.

Specialized collections may deal with particular types of debt, such as medical bills or student loans, and require specific knowledge and approaches.

What Does a Call Center Manager Do?

A call center manager oversees the entire operation of a call center. They are responsible for setting goals, managing budgets, and ensuring that the center meets its performance targets.

They also develop strategies to improve customer service and efficiency, and they work closely with other managers and supervisors to ensure the smooth operation of the call center.

Incorporating advanced technologies and strategies, including automated debt collection systems and effective communication strategies for debt collection agents, not only enhances productivity but also maximizes recovery rates. Entities like uContact, Vocalcom, and CallFasst demonstrate the powerful impact of combining technology with best practices in this field.

Check out this insightful video for a deeper understanding of how technology is shaping the future of debt collection in call centers:

Professor of motorcycle mechanics – My Future Job

Professor of motorcycle mechanics – My Future JobIncorporating strategies that range from personalizing debtor communication to leveraging omnichannel capabilities and predictive dialer technologies can significantly enhance the efficacy of Debt Collection Managers for Call Center operations. As the industry continues to evolve, so must the methods and tools used to ensure successful debt recovery outcomes.