In the highly competitive landscape of financial services, a Collections Coordinator emerges as a key player in maintaining a company’s fiscal stability. Through diligent management of accounts receivable, these professionals ensure the efficient recovery of debts, which is crucial for a business’s ability to invest and grow. In Colombia, the role garners respect and a competitive salary, reflecting the significant responsibilities it entails.

Understanding the multifaceted nature of collections and the diverse strategies employed to address varying levels of delinquency is fundamental. As we delve into the world of Personal Operativo – Cobranzas, we will explore the critical functions, skills, and education required to excel in this demanding yet rewarding career path.

What is a collections coordinator? Functions and salary

A Collections Coordinator is responsible for managing the collections process, supervising teams, and strategizing to meet targets. In Colombia, salaries for this crucial role range from approximately $1,380,000 to $6,000,000 monthly, with an average of $2,900,000, reflective of the expertise and effort required in this position.

The job involves not only overseeing the recovery of debts but also requires leadership, negotiation skills, and a deep understanding of legal regulations. Additionally, these professionals must be adept at communicating with clients and maintaining positive relationships, even in challenging circumstances.

Furthermore, a Collections Coordinator is expected to provide regular reports on the status of receivables, analyze collection data to improve strategies, and work closely with other departments to ensure a cohesive approach to financial management. The ability to handle stress and maintain composure is thus essential for success in this field.

What are the strategies for collections for each type of delinquency?

Effective collections strategies must be tailored to the stage of delinquency. For early-stage delinquents, proactive communication and automated reminders play a critical role in encouraging timely payments. Preventive collection efforts, focusing on client education and payment facilitation, can further mitigate the risk of accounts becoming delinquent.

- For mid-stage delinquency, negotiation and restructuring options may be explored.

- When dealing with late-stage delinquency, strong negotiation skills and legal knowledge are paramount in devising suitable recovery plans.

It is essential to strike a balance between firm collection efforts and maintaining customer relationships. Each strategy requires a nuanced approach that prioritizes both revenue recovery and client retention.

How does collection management impact companies?

Collection management is a cornerstone of financial stability for companies. It directly impacts cash flow, allowing businesses to meet their financial obligations and invest in growth opportunities. Efficient collection processes also signal to investors and stakeholders that the company is managing its receivables effectively, which can influence credit ratings and market perception.

On the inverse, poor collection practices can lead to cash shortages, difficulty in meeting operational expenses, and ultimately, may affect a company’s ability to stay afloat. Therefore, adept collection management is indispensable for long-term success.

What does a collections coordinator do and how much do they earn in Colombia?

In Colombia, the role of a Collections Coordinator is multifaceted. They oversee the collections department, develop strategies to minimize bad debt, and ensure that collection practices comply with legal standards. With a salary range reflecting the level of responsibility, these professionals earn between $1,380,000 and $6,000,000 monthly on average.

Their daily tasks include training teams, implementing policies, and liaising with other departments to ensure a unified approach to debt recovery. A thorough understanding of Colombia’s legal framework regarding debt collection is also essential for the role.

What are the 8 key functions, tasks, and responsibilities of this role?

The Collections Coordinator carries numerous responsibilities that are vital to the financial health of an organization. The eight key functions include:

- Developing and implementing collection strategies.

- Training and supervising collection staff.

- Monitoring debtor accounts to identify outstanding debts.

- Negotiating payment plans with debtors.

- Ensuring compliance with collection laws and regulations.

- Maintaining accurate records and reporting on collection activity.

- Improving collection processes to reduce the days sales outstanding (DSO).

- Building and maintaining positive relationships with clients to facilitate future collections.

What essential skills should a collections coordinator have on their resume?

A Collections Coordinator’s resume should highlight a range of skills that are indicative of their capacity to effectively manage debt recovery. Essential skills include:

- Excellent communication and negotiation abilities.

- Leadership skills to direct and motivate teams.

- Strong analytical skills to assess collection data and strategies.

- Knowledge of legal frameworks surrounding debt collection.

Additionally, proficiency in collection software and other related technologies is increasingly important in the modern financial landscape.

How can you become a collections coordinator and land a job in this role?

Becoming a Collections Coordinator requires a combination of education, experience, and skill development. Prospective candidates should focus on gaining experience in the field of debt management and enhancing their knowledge through certifications and specialized training. Building a strong understanding of financial principles and collection laws will also aid in securing a position in this field.

Networking and staying abreast of industry trends can further improve one’s chances of landing a role as a Collections Coordinator. It’s about showcasing not just the right qualifications but also the ability to adapt to the evolving strategies and technologies in collections.

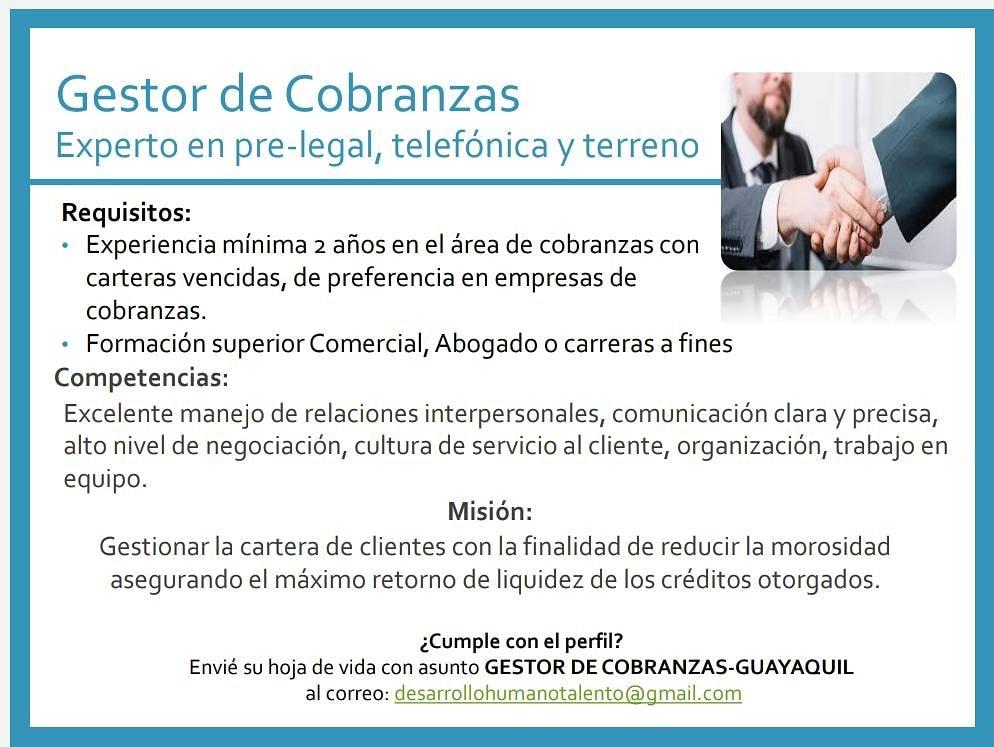

What education do you need to work as a collections coordinator?

The educational requirements for a Collections Coordinator typically include a bachelor’s degree in finance, business administration, or a related field. However, employers often value practical experience and a track record of success in collections or a related area just as highly.

Additional certifications in credit management or financial services can be advantageous, as they demonstrate a commitment to professional development and a thorough understanding of the industry.

What requirements and qualifications must you meet according to companies?

Companies looking to hire a Collections Coordinator commonly seek candidates with a combination of education, experience, and personal qualities. These qualifications often include:

- A bachelor’s degree in a relevant field.

- Proven experience in debt collection or accounts receivable management.

- Strong interpersonal and communication skills.

- An understanding of legal compliance in debt recovery.

Time management and problem-solving abilities are also frequently listed as desirable qualifications for this role.

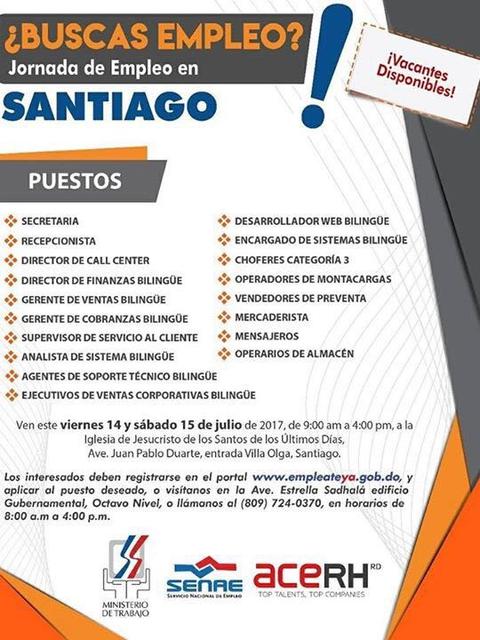

Where does a collections coordinator work? The most in-demand sectors

Collections Coordinators are in demand across various sectors, notably within finance, banking, and insurance. These industries often face significant volumes of receivables, making the role of a Collections Coordinator critical to their operations. Additionally, sectors like healthcare, telecommunications, and utilities also rely on these professionals to manage their billing and collections efficiently.

The skills of a Collections Coordinator are transferable to any industry where managing credit and receivables is a priority, making it a versatile career path.

What is preventive collections and how does it work?

Preventive collections focus on mitigating the risk of delinquency before it occurs. This proactive approach involves:

- Setting up payment reminders and alerts for customers.

- Providing financial education to clients on the importance of timely payments.

- Offering flexible payment solutions to accommodate different customer needs.

Such strategies aim to encourage a culture of prompt payment and reduce the incidence of overdue accounts.

How to lead your work team?

How to lead your work team?What are early and late delinquency collections?

Early delinquency collections address accounts that have just begun to show signs of non-payment. Quick intervention with automated messaging and soft communication can often resolve these issues before they escalate.

Late delinquency collections deal with accounts that have significantly overdue payments. Here, more intensive techniques, such as personal visits or legal action, may be necessary. The approach depends on the debtor’s circumstances and the company’s policies.

How can you benefit from collections software with omnichannel technology?

Today’s collections landscape is enhanced by software with omnichannel technology, which allows coordinators to engage with debtors across multiple platforms seamlessly. This integration ensures consistent communication and a better customer experience, which can lead to more successful debt recovery efforts.

Utilizing such software enables collections teams to track communications, automate processes, and analyze debtor behavior patterns, all of which contribute to a more efficient and effective collection strategy.

Why is the collections process important in businesses?

The collections process is a vital aspect of business operations, influencing liquidity and overall financial health. It ensures that companies have the cash flow necessary to meet their obligations and invest in future growth. A robust collections process can also protect a business from the risks associated with bad debt, which can have serious long-term consequences.

By prioritizing an effective collections strategy, businesses can maintain a steady stream of revenue and foster a sustainable financial ecosystem.

What is the impact of accounts receivable management on liquidity?

Accounts receivable management directly affects a company’s liquidity by influencing how quickly sales convert into cash. Efficient management leads to shorter cash conversion cycles, which can significantly improve a business’s ability to respond to market opportunities and financial commitments.

Poor management, conversely, can result in cash flow problems, making it difficult to cover operational expenses and potentially leading to increased borrowing, which can be costly and unsustainable in the long run.

What happens if you mismanage collections?

Mismanagement of collections can lead to serious financial issues for a business. It can cause a strain on cash flow, reduce the ability to pay suppliers or employees, damage creditworthiness, and ultimately lead to insolvency.

Therefore, it’s crucial that companies prioritize effective collection management to avoid such detrimental outcomes.

How can you improve your collections management?

Improving collections management involves several strategies, including:

- Implementing clear credit policies.

- Training staff on best practices and legal compliance.

- Leveraging technology to automate and streamline processes.

- Analyzing debtor data to personalize collection approaches.

Consistent evaluation and adaptation of these strategies are key to keeping up with changing market conditions and debtor behavior.

Why automating collections can benefit your business?

Automating the collections process can lead to significant benefits for businesses. Automation can improve efficiency, reduce errors, and free up staff to focus on complex cases that require a personal touch. It can also enhance the customer experience by providing consistent, timely, and accurate communication.

The adoption of such technologies can be a critical step in ensuring the long-term profitability and sustainability of a company’s collections department.

For a more in-depth understanding of the role of a Collections Coordinator, here’s a video explaining the key aspects:

Related questions about the collections coordinator role

What is a collections operative?

A collections operative, often synonymous with a Collections Coordinator, is a professional responsible for managing a team that conducts debt recovery for a business. They work on the front lines of financial operations, ensuring that outstanding debts are pursued and collected efficiently.

This role requires a mix of tactical planning, interpersonal skills, and a firm grasp of legal and regulatory frameworks to navigate the complexities of debt collection.

What does the collections staff do?

Collections staff play a critical part in the financial health of an organization by engaging with clients to recover unpaid debts. They use a variety of communication methods, including phone calls, emails, and letters, to remind customers of their obligations and negotiate payment terms when necessary.

Staff members receive training to handle these interactions professionally and effectively, often under the guidance of a Collections Coordinator.

What does collections personnel do?

Collections personnel are involved in the direct activities of pursuing overdue payments from clients. Their duties include contacting debtors, negotiating payment arrangements, and ensuring that payments are received and processed correctly.

They must keep accurate records of all communications and transactions, adhering to company policies and legal standards.

What are the three types of collections?

There are typically three types of collections strategies, each corresponding to different stages of delinquency:

Find the best job opportunities in Latin America

Find the best job opportunities in Latin America- Preventive collections: Aimed at educating customers and preventing overdue payments.

- Soft collections: For early delinquencies, focusing on friendly reminders and communication.

- Hard collections: Used for late-stage delinquencies and involve more assertive measures, potentially including legal action.

Each type requires a specific approach tailored to the debtor’s situation and the company’s policies.